Articles

In the event you wanted a managed profile and advice, robos try far much better than the conventional mutual money strategy. There’s nothing more significant to possess an investor than just leftover inside the exposure endurance level. By taking for the too much chance and you can bail on your opportunities throughout the industry changes, you make long lasting losings. It was said the only a great profile is one you could live with as a result of the ups and downs away from the marketplace. You can create a passive portfolio in as little as a stride, make a cautious band of common finance otherwise ETFs, or go all the-inside since the a home-led individual. You can decide which is right for you which have honest responses for some concerns.

Couch Potatoes Coupon FAQ

The theory is that, which profile should provide far more diversification, smaller risk. This type of gummies is federally judge to purchase on line if you are more than 21 yrs . old, the fresh delta-9 try acquired out of hemp, and also the THC articles is under .3percent by deceased weight of your finished device. Determining the right amount of THC gummies for taking depends on several items, generally the new mg of THC in the for each and every gummy along with your personal endurance.

It idiom is frequently always establish someone who spends extremely of their hours resting otherwise prone to the a settee, watching television or doing nothing. The phrase has become increasingly popular lately as the our community grows more inactive. Justin also has upgraded his common calculators, that you’ll install 100percent free for the the new Hand calculators part of your own PWL Investment webpages.

Speaking of edible snacks infused which have Delta-9-tetrahydrocannabinol, the main happy-gambler.com go to these guys psychoactive substance found in cannabis that give the newest vintage ‘high’. These gummies provide a managed and you may fun way to experience the negative effects of THC. If the yield to the 10-12 months federal securities spiked this past 12 months—from.88percent on may 16 of up to dos.55percent to the July 5—the worth of wide-dependent thread ETFs plummeted greatly. But We’ll bet a large number of traders believe their thread ETFs are performing even worse than just they are really. The brand new 3d games will not offer incentive cycles otherwise 100 percent free revolves however, have a bonus feature and you will a good jackpot that is not modern.

Since the stated this past 12 months, their come back over the past 3 years might have been much better than the quality Inactive. Either way, the idea of having seven to help you ten finance, in numerous size, is enough to lead to a lot of people to depart the space. Delta-9 gummies usually bring any where from half an hour so you can couple of hours in order to kick in. It is important to allow the gummies enough time to kick in just before eating up more, since there is generally a delay feeling in the usage.

Such one hundredpercent bond ETFs are ideal for reduced-chance traders however, deal with the same fixed-money threats that we have discussed earlier. Last for the Canadian Couch potato’s model collection number are such three thread ETFs supplied by the same financing managers because the just before. This type of ETFs is purely thread ETFs and so are not felt part of each of the about three professionals’ all-in-you to lineup.

Why Try Sofa Potatoes?

But I do believe we could all of the agree that rebalancing a two-fund profile isn’t likely to eliminate too many brain muscle. Dan Bortolotti, CFP, CIM, is a profile director and you may financial coordinator which have PWL Funding in the Toronto. He could be along with a veteran blogger and you will creator who may have written about personal financing for some Canadian guides, including MoneySense, the world and you will Mail and you may Financial Article.

Put simply, Canadians pay a few of the high charge worldwide to purchase earnestly treated mutual finance; in the 2percent happens off the best of the collateral financing’s money before you could see a red-colored cent. The new idle couch potato buyer is also make a profile for cheap than simply 1/ten of this cost—a lot more like 0.2percent otherwise reduced—and therefore much more investment earnings move into your membership instead of your advisor’s. The new asset allowance ETFs launched by the Vanguard and you may iShares within the 2018 have actually made it much easier than in the past to have people to construct a decreased-rates healthy collection. If you would like an internationally diversified blend of 80percent holds and you can 20percent ties, for example, the brand new Innovative Development ETF Profile (VGRO) often submit that with a single trade.

For each and every strategy possesses its own benefits and drawbacks, and you will investors should think about these types of points when deciding on an investment approach. When the a trader has a lesser risk threshold which is seeking money, they might see list financing otherwise ETFs you to invest in ties or other fixed-earnings securities. Because the portfolio is established, the brand new investor merely needs to rebalance it periodically to keep the fresh need resource allowance. However, if your inactive collection manages to lose smaller, what’s more, it gains smaller. Studying the 10-12 months several months 2010–2019, the fresh S&P five hundred has returned several.97percent and the couch potato portfolio 8.48percent.

- As i opposed the new State-of-the-art Profiles inside the March 2022, the brand new balanced growth profile try call at top, because of its higher allowance so you can holds.

- Just before going to your website, please check out the Disclaimer and you may Regulations web page.

- Justin offers a remarkable example of exactly how a trader just who made a large contribution prior to the newest financial crisis from 2008–09 might have had a great TWRR over cuatropercent even if their portfolio indeed lost value.

- Investors is actually surely using more geopolitical risks of development countries into account.

- You will i help the get back—or reduce the risk— with the addition of more money?

- Funds-of-finance like most of the ones protected over leave you availableness to numerous ETFs in a single head ETF.

Surprisingly, the sofa Potato Portfolio achieved less CAGR versus S&P five hundred, having approximately 1 / 2 of the new volatility, far quicker drawdowns, and much greater risk-adjusted get back (Sharpe). That is on the securities carrying out their job of protecting of the fresh downside threat of stocks. Supplied, the majority of this time around period – immediately after 1982 – is actually great for ties. This method will bring numerous professionals, and reduced charge and you will exchange costs, a passive method of paying, diversification due to list financing otherwise ETFs, and potential for much time-identity progress. They’re able to as well as help people dictate its exposure threshold and you will money desires and provide education on the dangers and you can advantages of couch potato using. Which allocation will be in accordance with the investor’s exposure endurance and you can investment wants.

SPAXX vs. FZFXX, FDIC, FCASH, FDRXX – Fidelity Center Condition

Conventional buyers will be allocate a greater to share in order to bonds (that are less risky) much less in order to holds. Aggressive traders takes far more exposure by allocating a high proportion to help you holds. Very people will be better-made by a balanced portfolio away from somewhere within 29percent and you can 80percent brings. Some paying tips are derived from choosing private stocks, and make financial forecasts, and you can time the brand new segments, Inactive traders recognize all of these issues is detrimental. They know you to definitely investors give themselves an elevated danger of success simply by taking the new productivity of your wide inventory and bond areas. The problem is you to exactly why are sense to your an excellent spreadsheet doesn’t always endure within the real life.

Ideas on how to Purchase Canadian Couch potato’s Doing it yourself ETF Portfolios

Immediately after all of the money is on the the new account, you might help make your the fresh Passive collection that have ETFs or index common finance. That’s rather easy nevertheless mode we are usually paying 50 to help you 67 percent of our cash in equities— common listing of “balanced” financing. A site available for Canadians who want to discover more about spending playing with directory shared finance and you can replace-traded fund.

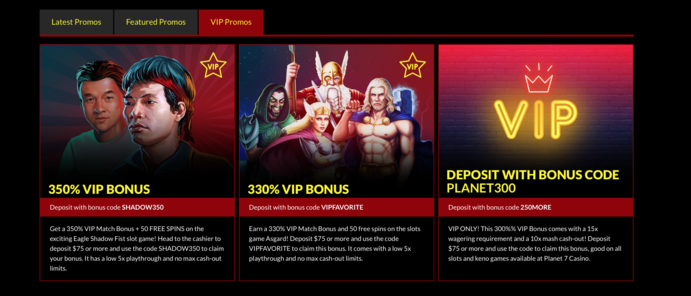

Diversification along with lets investors to capture the potential efficiency of numerous business areas, ultimately causing a possibly large overall profits on return. By comparison, passive using is designed to replicate the brand new overall performance out of a broad market list, ultimately causing lower charge and costs. Some casinos on the internet can give the overall game inside their applications thus you can find out when it is listed in the fresh slot machine game possibilities. There is absolutely no special application you’ll need for mobiles, but you’ll you would like a thumb user for the desktop computer otherwise laptop.

On the same go out, Trader dos needs an excellent twenty-five,100000 withdrawal to satisfy surprise debts. Since the profile manager made use of the exact same technique for each other people, he shouldn’t be compensated otherwise punished to the effect of bucks circulates over he had no manage. To explain, inside the seventies a popular name to your tv is actually, “the newest boob pipe” which had been created by individuals who experienced watching tv is a great quest just preferred by the stupid. As the edible element of an excellent potato plant is known as a great “tuber”, it’s aren’t thought that the phrase “passive” are implied because the an imaginative mixture of these basics.